Indexed Universal Life (IUL)

Indexed Universal Life Insurance (IUL) stands out as a cutting-edge option for building wealth. While it offers the standard death benefit typical of life insurance policies, it goes a step further by accumulating cash value within the policy itself. Notably, this cash component remains shielded from market volatility, can be withdrawn tax-free, and maintains liquidity.

Unlike with a 401(k), there’s no need to wait until reaching age 59.5+ to access this cash without facing penalties and taxes. This flexibility makes IUL an incredibly versatile asset, offering far more benefits than traditional life insurance policies.

Explore further to understand the intricacies of IUL and discover why incorporating it into your portfolio could be a wise decision.

What is Indexed Universal Life Insurance?

Indexed universal life insurance is a lifelong policy designed with a distinctive cash value accumulation structure, setting it apart from term insurance. While it provides coverage for your entire lifetime, its appeal extends beyond the death benefit, as many individuals leverage it for the growth potential of the cash value component.

Amidst the recent turbulence in the stock market, clients are seeking alternative avenues for growing their funds without exposing themselves to risk.

Although the 401(k) remains a popular retirement vehicle, it comes with market volatility, defers taxes until the future, and imposes penalties and taxes on withdrawals before age 59.5, making it less than ideal for many.

Recognizing these limitations, insurance companies developed indexed universal life insurance (IUL) to offer the tax advantages associated with life insurance policies while incorporating growth features devoid of potential losses.

Consumers are flocking to the safety of indexed universal life insurance as the product had $2.4 billion in sales for 2021.

Why Do You Want an IUL as Part of Your Portfolio?

Most people who look into IUL policies will use them as part of their retirement strategy. Tax-free loans from the policy make this particularly attractive if you expect tax rates to increase in the future. If you do not pay the loan back – no problem. The loan is paid back by being subtracted from the death benefit when you pass.

Some people looking into an indexed universal life policy use it as a supplemental wealth-building tool to their more traditional investments. There are no age restrictions on loans, unlike a 401(k) and IRA, so it allows for a more liquid wealth-building tool.

Avoid Stock Market Risk

Most people with investing knowledge can tell you that the stock market return averaged over its history is right around 8%. The lesser-known statistic is most investors average around 4% or half of the actual market returns.

A variety of factors combine to account for this minuscule growth. The biggest factor is emotion. Investors panic and sell when the market drops. Then they are not in the market when it goes back up. Timing the market is tough. Many investors buy high and sell low.

Warren Buffett says that the first rule of investing is to never lose money. The second rule of investing is not to forget rule #1. An IUL does not lose money due to stock market drops.

IULs have a growth floor, usually between 0% and 2%. For example, if you have $100,000 in a regular stock account and it drops 15%, you will be down to $85,000. If you had the same amount in the cash value of an IUL and the index drops 15%, you still have $100,000 (minus fees) because of the floor.

But here’s the best part. In our example, let’s say that same index grows 15% the next year. In your stock account, you would have $97,750 – almost back to where you started. But in your IUL, which didn’t lose any money the previous year, you would be up to $115,000.

The floor on the IUL prevents you from losing money, and more importantly, losing the time trying to regain your losses whenever the market drops.

This is a graph of how the money would have grown in an index compared to actually being in the S & P 500 (Index of the 500 largest U.S. publicly traded companies) over the past 20 years.

Both the indexed growth (blue line) with the cap and floor and the actual S & P growth (red line) start at $100,000. You can see that when the actual S & P has a down year, the index does not go down and is protected with the 0% floor.

You can see the difference in saving $100,000 in the S&P compared to an IUL with a 12% cap and 0% floor over the last 20 years. You would have earned $131,255.98 more with the IUL. The IUL growth is tax-deferred and tax-free when you take it out.

When the S&P has a negative year, the floor of 0% prevents a loss of principal. When the S&P has a gain, the IUL receives the same gain up to the cap.

Over time, protecting your downside, makes a big difference in your accumulated savings.

No Taxes

Most qualified plans, such as a 401(k), will be subject to income taxes when you take income from your account. IRA’s have the same tax problem.

In an IUL, you have a tax-free death benefit that will pass on to your heirs. If your estate is large enough to trigger estate taxes, your life insurance policy can be put into a trust to avoid these taxes.

Loans are not income, according to the IRS. Since you are borrowing the money from your IUL, and not taking income from it, you won’t pay income taxes on this money.

Also, because they are not taxable income, your yearly IUL loan in retirement won’t bump you up to a higher tax bracket. The distributions from your IUL are not reported on your tax return. As a result, this money also will not affect your social security taxes nor your medicare.

Death Benefit

IUL is a permanent life insurance policy. This means that you will not outlive the death benefit, whereas you probably will with a term policy.

If something unexpected happens, your IUL will pay out a life insurance death benefit to your heirs. If your agent designed the IUL correctly, the death benefit grows as you fund the policy.

The death benefit pays out tax-free. This provides unbeatable peace of mind for you and your loved ones.

IUL Fees are Less Than Other Options

One of the most common myths about Indexed Universal Life insurance is that it is exorbitantly expensive. You’ll read this a lot from advisors who don’t want to lose your money to an IUL. IULs indeed have higher fees initially. For the first 5-10 years, depending on someone’s age and health, the IUL will have higher fees than other financial vehicles. However, you may have this policy to age 80, 90, or beyond. If you’re 40 years old now, this policy may be with you for the next 50-60 years.

Fees are front-loaded in an IUL. They start higher and then decrease. After the first 10 years or so, the IUL fees begin to become less than the prices in other options. When you look at the costs over 30-40 years or more, the total IUL fees are much less than other options over time.

Watch the case study video below. I will show you in detail how the IUL fees compare.

The other point is that “fees are only a problem in the absence of value.” I personally don’t mind paying fees if I’m getting more in return than what I pay. Think about what you are receiving for the expenses in an IUL:

- Tax-free distributions (this alone is worth much more than the fees)

- Guaranteed protection from a stock market drop

- Life insurance tax-free death benefit

- Unstructured loans

- Indexed growth

- Creditor Protection (varies by state law)

- Living benefits

The IUL Loan Structure

Utilizing tax-free loans is a compelling aspect of incorporating an Indexed Universal Life (IUL) insurance policy into retirement income planning, yet many consumers remain uninformed about this feature.

IULs offer various types of loans, with the focus here on Indexed or Participating loans. Accessing funds from your policy is straightforward – you simply contact the insurance company and specify the desired amount.

Indexed universal life loans do not necessitate applications; if the cash value is available in your account, borrowing is accessible.

Notably, the borrowed amount remains in your policy, accruing compound interest. Typically, you’d aim to repay the loan to reuse the funds for future purposes like car purchases or home renovations.

The benefit of a participating loan lies in the fact that the loaned amount continues to earn interest within your policy. The interest rate for borrowing is usually around 5-6%, offering the potential for positive arbitrage when the policy earns a higher indexed interest rate.

Even in years with lower interest earnings, the policy’s average rate of return (currently 6-9%) statistically results in positive arbitrage, allowing for continuous growth of cash value.

Flexible repayment terms further enhance IUL loans, enabling borrowers to customize repayment timelines according to their preferences, whether it’s over 3, 5, or 15 years. This flexibility grants control over financial planning and helps optimize the benefits of the policy for long-term wealth-building and retirement income.

Case Study of an IUL Compared to Other Financial Vehicles

Is Indexed Universal Life Insurance Too Good To Be True?

Families have used permanent life insurance to build wealth for over 100 years. It’s not just the wealth within the cash value. You can use the loans at any time for any reason. You can use it to pay for vacations or cover a financial emergency, instead of depleting your savings. If an investment opportunity presents itself, you have the liquid capital to take advantage of it. Some people even use it to fund their businesses.

During the Great Depression in the 1920s, JCPenny was facing bankruptcy – closing its doors and putting even more people out of work. James Peny took out a loan from his life insurance contract instead of shutting down his store like so many others. It kept the lights on until the store could become profitable again.

The story of how McDonald’s turned into the popular franchise it is today has been the subject of several docu-dramas over the past few years. Yet few people know that a life insurance loan provided the capital to get it off the ground.

College sports coaches are cashing in on the tax-advantages of life insurance as well. Jim Harbaugh the University of Michigan football coach, is receiving part of his compensation in the form of cash value life insurance.

Because this particular style of life insurance offers growth that’s sheltered from taxes, it becomes an excellent vehicle to build up liquid assets.

When you have your million dollar idea, you don’t need to beg for venture capital and compete against the 15 other pitches that day. You can do anything with the money: Take that dream vacation. Pay for your children’s college tuition. The insurance company doesn’t care what you do with the money, and they don’t ask.

Tax Code 7702, TEFRA, DEFRA, TAMRA

I don’t want to bore you with the details, but these are IRS Codes that explain what qualifies as life insurance and how life insurance is taxed. As life insurance policies have evolved over the years, the IRS has added these new laws.

Life insurance is an incredible tax shelter. Naturally, the IRS wants to have their say in the plan. These IRS codes set limits on the amount of cash value in the policy compared to the death benefit.

They also established rules on the abuse of life insurance and how it can become taxable. These laws also created the MEC rule and 7-pay test, which we’ll discuss below.

Is this a bad thing? No. Life insurance still has some fantastic tax benefits, but you need to play by the rules.

MEC Rule

In the 80s, using life insurance as a wealth-building vehicle was so popular that the legislature had to impose new restrictions to prevent a massive tax loophole. Now, life insurance policies must pass a 7-pay test. If they fail, the IRS considers them a Modified Endowment Contract (MEC) and are subject to taxes. A MEC is very similar to how a 401(k) or IRA is taxed.

Before the MEC rule, you could fund an entire policy with a single payment. Now you have to pay premiums over at least 5 years to maintain all of the tax benefits listed above.

This tricky rule is one of the primary reasons it’s wise to work with an insurance agent who has experience in designing indexed universal life policies. They need to know how to avoid the MEC classification. They also need to understand how to maximize the growth of the cash value rather than follow whole life or term policy design.

How The Cash Value Works – Technical Description

Never losing money on your cash value still sounds a little too fantastic to be real. Below are the internal mechanics of how the life insurance company hedges the risk to make sure that you never lose money, and that they can credit your account with the gains analogous to the index that it’s tied to.

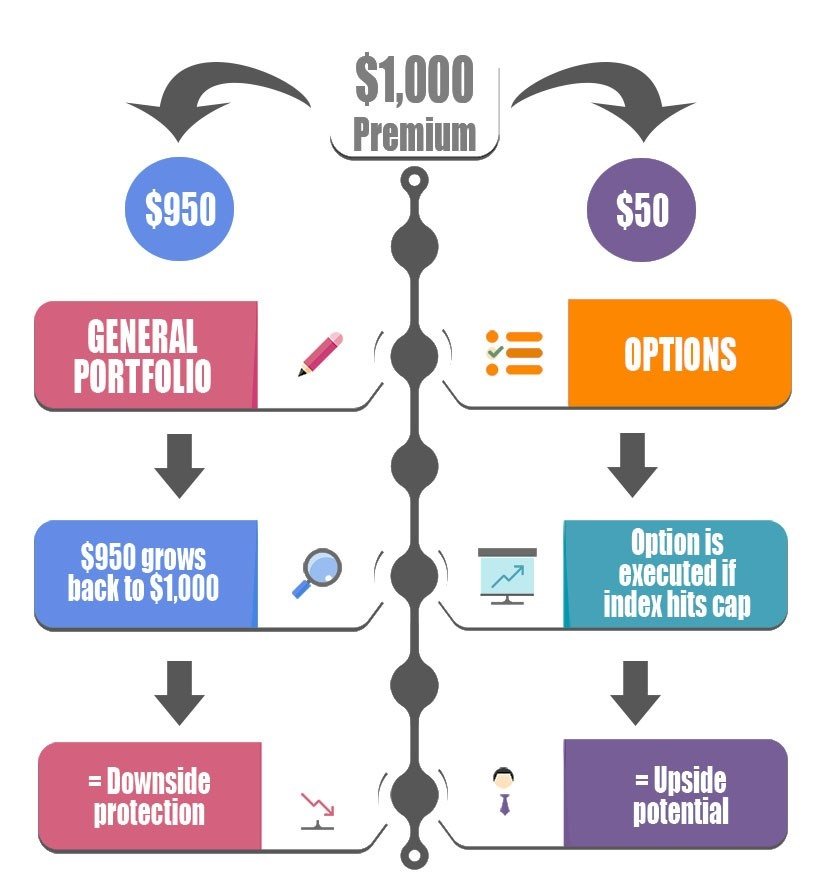

Hedging Example:

Let’s say you pay a $1,000 premium into your IUL policy.

- The insurance company puts $950 into high quality, investment-grade bonds. This $950 will grow back to $1,000 at the end of the year. This is how the insurance company protects the downside.

- $50 is used to purchase options. Let’s say the S&P has a 10% cap. When the S&P hits 10%, the option is exercised. This will provide the 10% upside on the index.

A common myth I hear is that the insurance company keeps the gains over the cap. For instance if the S & P returns 15% and there is a cap of 10%, the insurance just made 5% on your money. Not true! The insurance company must exercise the hedge at the cap and does not make any money on the difference.

None of your money is ever directly invested in an index. The insurance company uses the index as a measurement for how much interest to credit to your policy.

Differences Between IUL and Other Types of Life Insurance

Indexed universal life is unique among its insurance counterparts. It has different purposes than other types of insurance, and its own set of quirks.

Term Life

Term life focuses exclusively on the death benefit. The length of the term typically matches the duration of a mortgage or the years until young children become financially independent.

Think of term as renting insurance. It will cover you for the duration of the term, usually 10 – 40 years. Then the term ends. It does not build up cash value.

The life insurance portion of an IUL lasts for your entire life, and it builds up tax-free cash.

Whole Life

Whole life insurance stays in place for your entire life. It still ranks #1 in terms of popularity today, despite term life being a better choice for many families. Current whole life policies offer a cash value accumulation, making it a predecessor to indexed universal life.

The main difference between the two is the cash value in whole life grows through the insurer paying dividends to their policyholders. Dividends are declared annually based on the overall performance of the insurance company.

While many whole life insurance companies have a long track record of paying dividends, these dividends are not guaranteed. The interest rate declared by the dividends has been trending down for a long time.

Both whole life and IUL last for the entire lifetime of the insured. Both have a cash value (CV) accumulation component. The main difference is the CV of an IUL is tied to an index, usually the S&P 500, whereas the CV on a whole life policy is based on less transparent dividends.

I believe IULs have a better chance of earning a higher rate of interest than their whole counterparts. IULs also have lower expenses and are more transparent with their fees.

The other big advantage of IULs, in my opinion, is that IULs have flexible premiums. You can pay less if you need to and can catch up premiums in the future.

Universal Life

Universal life and indexed universal life are similar. They both have remarkable flexibility, allowing you to adjust the policy after you’ve taken it out as your financial situation changes.

The biggest difference is indexed universal life grows the cash value based on an index. Universal life grows the cash value based on a declared interest rate by the insurance company.

Guaranteed Universal Life policies are great if you want a lifetime policy with a smaller premium and no cash value.

Variable Universal Life

Variable Universal Life policies are the riskiest type of permanent life insurance policy. While they may not have a cap on the growth, they also don’t have a floor. If the market goes down, your principal can go down.

I don’t recommend VUL and feel that an IUL has the best combination of growth and protection.

Why Some Advisors Don’t Recommend Indexed Universal Life

If you google “indexed universal life insurance,” you will find strong opinions—a few in favor of, but many firmly against it. Even the financial talk show hosts have extreme views about IUL policies.

Their advice doesn’t apply to you

Consider whether you fall into the top 25% of income earners ($84,000/year +) in this country when weighing these opinions. Most people (The bottom 75%) have an income problem, not a tax problem.

Wealth building advice for the bottom 75% typically boils down to: pay off your debts, contribute to your qualified retirement accounts up to your employer match, and don’t spend more than you earn. They do not need help minimizing their tax burden.

General audience advice from insurance experts online and talking heads on TV, focuses on this larger audience. It’s the smart business decision for their businesses.

The higher you climb in income, the more specialized advice you need. A CEO will need different tax minimization strategies than their employees. A doctor will need different financial advice than someone on the hospital admin team. So ask yourself, “are these people talking to me?”

Indexed universal life is misunderstood – even by many insurance agents and financial advisors

Indexed universal life has many moving parts. People don’t recommend things that they don’t understand. It’s a more complex insurance policy. However, it can provide a lot more than most insurance policies, if designed with your best interest in mind.

I have read countless articles online that are outright lies, twisted facts, or misunderstood concepts. Anyone can put up a blog post online, and many who do are professional writers. They are not knowledgeable insurance agents or financial advisors. They have no experience designing an IUL. People don’t know what they don’t know.

If you see something online that you have questions about, contact us. We will explain the truth with math, historical data, and economics to back it up.

Just by reading this article, you’ll know more than most insurance agents. If you really want to learn more, I highly encourage you to watch our video course on building tax-free wealth with life insurance. You can access it for free here:

Term insurance is easier to sell because it’s so simple. It’s in the agent’s best interest to sell the easier solution and then move on to the next sale.

Indexed universal life insurance can be an integral part of an overall financial plan. If you want a portfolio protected from risk and taxes, an IUL can be the base of that plan. We often use IUL as one asset and then will layer in some tactically managed stock strategies and/or an annuity depending on the client’s goals.

If you are interested in an overall financial plan, take a look at our Retirement Income Shortfall Analysis. We will tell you honestly if an IUL should be part of your financial plan or not. It’s not a one size fits all.

Some financial advisors and wealth managers are not allowed to sell IUL

Financial advisors often don’t recommend IUL policies because their company doesn’t allow them to use life insurance to grow their clients’ assets. They want you to keep your money in their stock and bond portfolio.

Why? Because that advisor and company want to continue earning their 1% (or more) fee year after year. They will make more money over time by earning their annual fee rather than a life insurance commission.

We don’t think that that is fair to clients. We are product agnostic. We don’t look at the fees we earn. We look at how best to prepare our clients for success. Life insurance, assets under management, annuities – we don’t care what we make on a product. We care about helping our clients have a successful retirement.

Are we giving up some revenue when putting money in life insurance rather than in a stock portfolio? Yes. Do we care? No.

Our goal, plain and simple, is to help our clients best prepare for retirement. If a life insurance policy is an important asset for market and tax protection, we won’t hesitate to recommend one.

If you absolutely don’t want a life insurance policy, no problem. We work with all financial vehicles, and our sole purpose is to work with you to best help your situation.

Whole life agents despise IUL

Many life insurance agents that industry insiders refer to as Whole-Lifers. They sell whole life insurance to everyone and won’t give an IUL a chance. Some of these are captive agents, who can only sell one company’s products. If they don’t have an IUL in their portfolio, they will do anything to convince you that their whole life is better.

Some of these agents use clever marketing tactics such as Bank on Yourself or Be Your Own Bank. These are simply marketing strategies to sell more whole life insurance. Some of them have some merit, but you can get better results with a properly structured IUL.

Whole life insurance presents a more familiar product to an agent’s potential clients. The agent doesn’t have to overcome the unfamiliarity hurdle.

Again, we are product agnostic, and we do sell whole life insurance. Whole life may be a better fit if you are older, are financially conservative, or want more guarantees. More guarantees mean more expense and less opportunity for growth in the policy.

Whole life insurance is not bad. It’s just a different policy design.

Wondering which is best for you? We’re happy to provide an unbiased analysis of both. Then you can decide what’s best for you.

We encourage you to read both sides of the IUL argument when deciding whether it’s a good fit for your financial situation. The best thing you can do is to dig deep and understand the mechanics of any wealth-building vehicle. Then decide if it fits your current goals.

How does an IUL Compare to Different Non-Insurance Options?

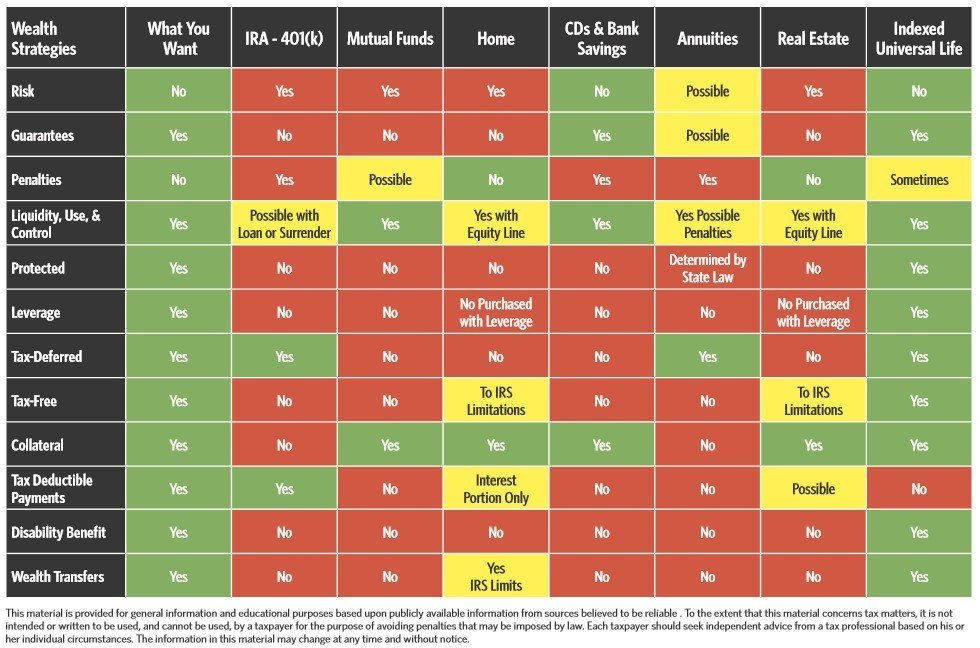

There are many different vehicles to save for retirement. The following chart highlights some of the most common options.

Check out the first column on the left. This is a list of features that you most likely want in a plan. Then look at each option. The green boxes show that the option offers what you want. The red box means that they do not offer that feature.

The last column on the right is the IUL. How does it compare to the other options?

To expand on an IUL versus other qualified retirement plans, read our comprehensive article here. You will find projection tables of how long money lasts in retirement, as well as what you can do to maximize your income by combining several strategies.

IUL with Living Benefits

If you make it to age 65, there’s a pretty good chance that you will live into your 80s – especially if you are married. Longer living means a health issue is more likely to appear at some point. Some indexed universal life insurance policies offer living benefits to policyholders.

Living benefits are free riders that allow you to access your death benefit if diagnosed with a qualifying illness. This is usually an acceleration of the death benefit. If your policy has a $2,000,000 death benefit, and you use $500,000 for living benefits, then your heirs will receive $1,500,000 when you pass.

The benefit is unrestricted, depending on the company, and available for any expense. Expenses might include, but are not limited to:

| Household expenses | Adult Day Care |

| Home modifications | Regular Bills |

| Nursing home care | Trip around the world |

Living benefits usually include the following riders:

- Terminal Illness

- Chronic Illness

- Critical Illness

Terminal Illness

A terminal illness is an illness that will result in death within 12 to 24 months. The duration varies by state law.

Chronic Illness

A chronic illness is when you are unable to perform two out of six “activities of daily living” for a period of at least 90 days or are cognitively impaired.

Activities of daily living include:

| Bathing | Continence | Dressing |

| Eating | Toileting | Transferring |

According to Genworth’s Cost of Care survey, the average cost of a private room in a nursing home is $108,405 per year. Statistics show that 70% of people over age 65 will need some form of assisted care.

If you don’t plan ahead for this, it will be a shock to your retirement income plan. Including living benefit riders or having extra accessible cash in your IUL can help you navigate this risk.

Qualified retirement plans, such as your 401(k) do not offer options like this.

Critical Illness or Critical Injury

This rider provides funds if diagnosed with one of the following illnesses (qualifying illness varies by company).

Critical illness may include:

| ALS (Lou Gehrig’s disease) | Aorta Graft Surgery | Aplastic Anemia | Blindness |

| Cancer | Cystic Fibrosis | End Stage Renal Failure | Heart Attack |

| Heart Valve Replacement | Major Organ Transplant | Motor Neuron Disease | Stroke |

| Sudden Cardiac Arrest |

Critical injury may include:

| Coma | Paralysis |

| Severe Burns | Traumatic Brain Injury |

According to the CDC, someone in the United States has a stroke every 40 seconds. That means each year, more than 795,000 people in the United States have a stroke. About 610,000 of these are first or new strokes.

We hope you never experience any of these issues. Just in case you do, living benefits can provide peace of mind and money to help you survive.

How to Supercharge your Indexed Universal Life Policy

What if there were ways to leverage your premium payments to build your cash value larger? A couple of strategies provide additional funding to increase your death benefit and cash value – with no additional money out of your pocket.

This is similar to how most Americans use a mortgage to buy a bigger house. You can also use financial leverage to buy a bigger life insurance policy.

Life Insurance Plus Leverage (Kaizen)

Kaizen is a strategy that leverages your life insurance premiums 3 to 1. You put in 25% of the premiums, and a bank puts in 75% of the premiums. You have to qualify with an income of $100,000+.

Kaizen works like this. You pay a premium for 5 years. A bank will match your premium for the first 5 years. Then the bank will pay all of the premiums for the next 5 years.

The policy becomes fully funded after 10 years. Remember, you only contributed payments for 5 years. After the contributions over 10 years, we then let the cash in the policy grow for another 5 years. At year 15, the bank is paid back out of the policy’s cash value.

You now have a paid up IUL with 60% to 100% more retirement income than you would have without Kaizen.

The policy serves as the sole collateral for the loan, so there are no personal guarantees nor loan applications to complete. Over 5 billion dollars have been financed into IULs through the Kaizen strategies since 2000.

It’s a great way to leverage your money to get more of what you want.

Premium Financing for Life Insurance

Premium financing is another strategy using leverage for a larger IUL. This strategy is for high net worth individuals with a $5,000,000+ net worth. A person who needs life insurance but doesn’t have the liquid cash to pay the premiums on a large policy is a great candidate for premium financing.

These policies are used for estate tax planning, wealth transfers, and business planning.

All you need is to make the interest payments on a loan for the first few years. As long as your net worth and collateral will satisfy the bank, they will pay your life insurance premiums. Similar to the Kaizen plan above, at some point, enough cash builds in the policy to pay back the loan.

Then you are left with a fully-funded IUL. Our premium financing team has banks lined up that will work with us on these policies. You can learn more about premium financing here.

Indexed Universal Life Insurance Warnings

If indexed universal life seems like it may fit with your financial plans, there are a few pitfalls to watch.

The two biggest issues I have seen are:

- Agent does not design the policy properly

- Client does not fund policy as they intended

Policy Design

When using the policy to maximize tax-free income, your agent must design the policy to be maximum-funded. Maximum funded means the death benefit is as small as possible based on the premium going into the policy.

Policy Design Example

Let’s say a healthy 40 year old male wants to put $1,000/month into an IUL until he is 65. Then he takes tax-free distributions from age 66 to 100. To maximum-fund the policy, the death benefit should start at $343,006. This will provide distributions of approximately $80,453/year (tax-free) from age 66 to 100.

Now, let’s say an uneducated agent starts the death benefit at $686,012. Using the same $1,000/month funding, the tax-free distributions are now $70,981/year from 66 to 100.

This agent just cost their client $322,048 in tax-free income if he lives to age 100. While lowering the client’s income by 12%, the agent also doubled their compensation.

We always maximum fund the IUL for our clients who want income. Sometimes a client also wants a higher death benefit. In that case, we’ll design the policy to have a higher death benefit while also maximizing income.

The reason the policy works this way is that the cost of insurance is based on the amount of death benefit. The higher the death benefit, the higher the cost of insurance. If more of the premium has to cover the insurance cost, there is less available to build up the cash value.

Unscrupulous and uneducated agents may not know these things. There is no single training for life insurance agents. There are a variety of educational programs focused around passing the agent exam. Those don’t deal with the intricacies of each policy type. It focuses on federal and state regulations. An agent without expertise in IUL may design a policy along the usual logic – max death benefit for minimal premiums.

Client Funding

I’d like to say that every client who starts an IUL pays every premium as intended. In reality, that does not always happen. Life happens: job loss, emergencies, health issues, etc. The client intended to save $20,000/year for 20 years, but 10 years in something happens, and they cannot save.

Life insurance is just like any other financial vehicle. The more you save, the more you’ll have later in retirement. If you don’t save as much, you won’t have as much. It’s not the policy’s fault, so don’t blame the IUL.

The good thing is that IUL’s have flexible premiums. That means if life happens and you don’t save as much, the policy won’t necessarily blow up and lapse. It means you won’t get quite as much income as you expected in the future.

In the example above, what happens if this person saves $1,000/month for 10 years, but then can only afford to save $500/month to age 65? If that happens, the tax-free income is now $62,557 instead of $80,453.

What if the same person puts in $1,000/month for 10 years, then doesn’t save any more money? The income at age 65 is then $44,503. It’s not the end of the world, and you still have some tax-free income in retirement.

As long as you have some cash built up in the policy, you can skip payments if you need to. Then play catch-up later, if you are able. This is another reason why I prefer IUL over whole life insurance. If you miss a Whole Life payment, that missed payment may become a loan against the policy. Then it will drag down the performance of the policy even more.

Caps, participation rates and spreads will change over time

Every insurance company offers different index options for their IULs. The one commonality is that these policies can’t be credited with negative interest in a down year. This is the floor, which is 0%.

When the market is down 30%, and your policy only receives a 0%, this is great because you don’t have to make up that principal loss. We say, “Zero is your Hero.”

Each index may have a cap, spread, or participation rate on the upside growth. These rates will change over time. When interest rates are down, these rates tend to be lower. When rates increase, they trend upward.

These changes are not because the insurance company is trying to make more money. It has to do with the cost of options within the hedging explained above.

Every policy anniversary, you have the option to change the indices your IUL is invested in. If one drops, and you have a hunch that another will perform better, you can change to another option.

Again, this isn’t a bad thing, because the floor of 0% is guaranteed. Just know that the rates will change slightly, up or down, from year to year.

The Cost of Insurance Could Change

It is possible, though highly unlikely, that the insurance company could change the insurance cost within the policy. The insurance company can’t single you out and change your cost of insurance only. They would have to change it across the entire block of business.

Unless the insurance company has a great reason to do so, I don’t see this happening. It would have to be something crazy, like millions of policyholders from that one company all dying at once.

The other reason I don’t see this happening is that you can cash out of these policies. Nothing stops you from taking your surrender value and walking away with it.

There is a surrender charge for the first 10 – 15 years for most companies. This is an amount of cash that you would leave behind if you walked away. However, if your agent designed the policy properly, you may have more cash in your policy than you put in, including the surrender charge, after 5 – 7 years.

The insurance company wants to keep these policies in force for many years. This is how they earn money. If a bunch of policyholders canceled their policies, it would hurt the profitability of the insurance company.

What if the market has a series of bad years?

If the stock market is down many years in a row, that is all the more reason to have an IUL in your portfolio.This is a worst-case scenario for the first few years you hold the policy. You are paying to build the cash value and it’s sitting right around the growth floor.

However, what is the alternative? If your money is in the market, without the floor of 0%, you’ll be losing much more than just the cost of insurance. You’ll lose your principal. When you lose principal, you have to gain a lot more to get back to where you started.

The following chart shows what interest rate you need to earn to get back to even after a loss.

| Starting Account Balance | Percentage Loss | Ending Account Balance After Loss | % Gain Needed to Restore Loss | Ending Balance After Gain |

|---|---|---|---|---|

| $1,000 | -10% | $950 | 11.1% | $1,000 |

| $1,000 | -20% | $800 | 25% | $1,000 |

| $1,000 | -30% | $700 | 42.9% | $1,000 |

| $1,000 | -40% | $600 | 66.7% | $1,000 |

| $1,000 | -50% | $500 | 100% | $1,000 |

Remember that it’s better to protect your downside than take the risk of hitting a home run.

An IUL will protect your downside. So what happens if we have many bad years in a row? It’s bound to happen with the volatility of the market. If we look back at the last 20 years of the S & P, there was a period when the market was down 3 years in a row (2001-2003).

Over the last 20 years (2000-2019), the actual return of the S&P was 4.02 percent. The return of the IUL with a floor of 0% and cap of 12% was 6.48%.

As you can see, you would have been better off with a cap and floor than getting all of the upside and downside of the market. None of us know what the future holds. What if your policy was illustrated at 6% and you earn 5% over the next 20 years? Then your income will be a little lower.

We don’t recommend having all of your eggs in one basket. Have some money in the market and some in a safe vehicle, such as an IUL. When the market is down, you’ll feel relief with the safety of your IUL bucket. If the market has a great year, your money in the market will do great, and your IUL will still do good relatively speaking.

150% Strategy

I learned a concept many years ago called the 150% rule. It’s a simple financial planning strategy. Let me show you how this works:

The percentages can be adjusted depending on your risk preference. This shows how the IUL can be utilized to protect your money in a down market. It can also grow your money in an up market.

If you want to see a complete financial plan of how an IUL and other financial vehicles can help improve your chances of a successful retirement, please reach out to us.

Why work with USA Investment Solutions on your IUL?

We practice what we preach. We believe in the strength and value of indexed universal life. Michael, our CEO and Financial Advisor, has owned his own IUL for many years. We’ve gone through the design and building process ourselves. Michael is a fiduciary, which means his client’s interests always come first and are the highest priority.

As stated before, we are product agnostic. If you want term, whole life, IUL, annuities, or tactically managed investments, we can help and are not personally swayed by which product you prefer. Our goal is to help you be better prepared for retirement – regardless of how we get you there or which products you choose.

We can hop on a screen-share and thoroughly explain any concepts and answer all of your questions. If we do end up working together, we will be there to review your IUL or other products every year. We’re not here to make a quick sale. We’re here to develop a relationship with you as a trusted advisor.

Not all wealth-building vehicles are right for everyone. If you have any questions or want to know if this may be right for you, give us a call today at (714) 794-2009. We’re happy to help with no obligation.